World economy, what next?

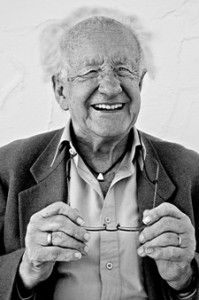

By Johan Galtung

Washington, DC

The Big View is the West doing badly, euro and pound down with miserable growth rates; US $-growth rate better but erratic; China, India, Islam growing, Latin America (CELAC) getting its act together and probably growing. This matters for essentially bankrupt USA: China, India, Islam, CELAC are huge powers with huge minorities inside the USA: they could move in, take over. Last week’s prediction about Trump’s foreign policy came true the next day (Washington Post 22 Mar 2016): less wars, not affordable, less NATO, let Europe do it, no nation-building, building our own. He was then branded “isolationist” with US incapacity for a third option: foreign policy by peacefare.

Diagnosis

Any economy has two key faultlines: high vs low class, with inequality by exploitation; real vs finance economy, with crises by speculation. LEAP Press Review (noreply@leap2020.net 17 Feb 2016) traces “something Big was about to happen” to February 2006: no more M3 published (money printing); Iran’ stock market based on the euro, Iraq following (invasion). Before that, the Rest manufacturing, beating the West. Slow in coming, but then quickly; leaving the USA with agriculture and speculation, maybe to be followed by a Brexit UK.

Martin Wolf (Financial Times, english@other-news.info 24 Feb 2016) points to the world exhausting “monetary policy 1,2”-lower interest, printing money-and calls for nº 3: more spending, less saving to beat the “chronic demand crisis”. A non-starter: given the inequalities and crises, people will save for worse to come and for their children, not spend unnecessarily, and not accumulate debts to their children.

Joseph Stiglitz (above) puts it this way: “Banks choose financial speculation over lending /for/ economic growth”. The money supply “stimulated sharp increases in-financial-sector profitability”.

Rune Skarstein, the leading Norwegian global economist, focuses on the slipping locomotive effect from the Chinese economy; buying resources from developing countries, giving cheap credit to developed countries indebted by bailing out failing banks (and selling cheap consumer goods, alleviating the austerity policies). Nevertheless, why blind reliance on a China that might change economic policy, also in USA? (Klassekampen 2 Mar 2016, for similar points, see INYT 11 Jan 2016).

Paul Buchheit (Nation of Change 9 Dec 2013), “Three Ways the Super-Rich Suck Wealth Out of the Rest of Us”, on quantity and mechanisms: from the 2008 recession till the end of 2013 “the richest US 5% (six million households) own–$ 10 trillion of the $ 15 trillion gained–from stock market gains rather than from job-creating business” (The Nation, 7 Mar 2016, pp. 13-16, has even more shocking figures, so does the OXFAM Briefing Paper “An Economy for the 1%”, 18 Jan 2016).

“The speculative-derivatives market has increased to-over $ 1 quadrillion-twenty times more than the world economy-US driving the expansion of this great bubble of wealth-global inequality between rather than within countries has become even worse than for any one country. Just 250 individuals have more money than half the world”.

The working class is not rewarded for productivity–financial industry-extracts wealth from society. Median household income dropped from $73,000 to $57,000 over 25 years. A major livelihood decrease.

Joseph Stiglitz, with an academic life spent on inequality, is summarized in a review by James Surowiecki (NYRB 24 Sep 2015), ending with “high marginal tax rates on the rich and meaningful investment in public infrastructure, education and technology”. However, the funds generated these ways may easily end up in the “financial industry”.

Zhou Xiaochuan, People’s Bank of China governor: “The growth target of 6.5-7% for 2016 was made on the basis of China’s growth-in the past and its growth potential”. Adding, “China now seeks growth by relying more on domestic demand, while export is unable to contribute to growth the way it used to” (The Weekly Mirror, Nepal, 18 Mar 2016).

More investment-consumption in China; more GDP, less GNP, growth; no money printing-speculation; massive job creation-investment-infrastructure, massive inequality (mostly territorial), massive lifting up the bottom, in the field, locally. With “silk (rail)roads” for all.

Prognosis

Larry Summers in 2009 predicted “the new economy”: “Unemployment would be normal-the market the center of economy and finance-social welfare would no longer be the economy’s concern”. Klaus Schwab, founder of the World Economic Forum: “In a decade robots will account for 52% of industrial production, up from present 12%”. (Roberto Savio, “Are We Entering a Long Term Stagnation?” 17 Mar 2016). Self-fulfilling predictions by people not hit by the social disasters.

Therapy

USA pins its hopes on TPP(TTIP), but other countries worry greatly about Chapter 28 on “Dispute Settlement”, in Washington, so far in favor of USA; not counteracting Summers and Schwab visions.

Go straight to the basic problems: speculation and exploitation!

Derivative-based speculation is a US economic cancer metastasizing around the world. Criminalize, separate savings and investment banks, and US banking from the world. Fail to do so, and suffer the crises.

Inequality due to exploitation is built into the present “free” market; some state control is indispensable. Yet, even better, people control at the roots. What China did in the poorest communities, the West can do in the worst companies, boycotting companies with CEO-worker income ratios above 10, building cooperatives, sharing benefits-risks. By reviving all economic sectors, trading with all, dependent on none.

Anthony Atkinson, Inequality: What Can Be Done? Harvard, 2015, is superb but not on what is said above. Thomas Piketty’s Capital relies much on taxing the rich-like most economists-a negative approach. A greener economy is as indispensable for nature as fighting speculation and exploitation to humans. We need all three, not only two, or one.

And Pope Francis covered them all in Laudato Si’. A strong force.

NOTE:

* The reader will find much more in Johan Galtung, Peace Economics, TRANSCEND University Press 2012.

Originally published at Transcend Media Service here.